Annual Tax Free Gift Allowance 2024. These gifts can include cash as well. Kapamilya daily mass | march 9, 2024.

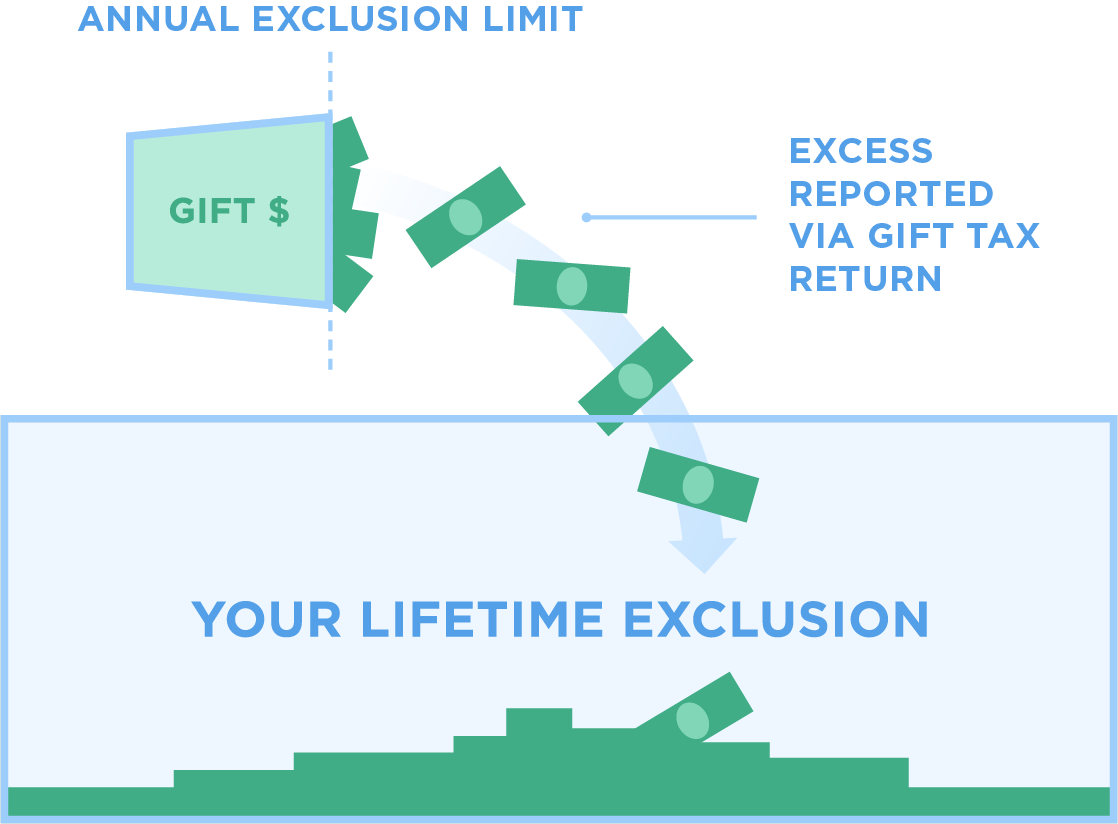

Gifting more than this sum means you must file a federal. Starting from calendar year 2024, the annual exclusion for gifts will increase to $18,000, up from $17,000 in 2023.

These Gifts Can Include Cash As Well.

In general, the gift tax and estate tax provisions apply a unified rate schedule to a person’s cumulative taxable gifts and taxable estate to.

The 2024 Gift Tax Limit Is $18,000.

The united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2024.

These Gifts Can Include Cash As Well As Other Types Of Property.

Essential filing tips for 2024.

Images References :

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group The Annual Gift Tax Exemption What You Need To Know, As per the law, as it stands today which was amended in 2017, gifts received by any person by any person or persons are taxed in the hands of the recipient. Starting from calendar year 2024, the annual exclusion for gifts will increase to $18,000, up from $17,000 in 2023.

Source: www.businesstoday.in

Source: www.businesstoday.in

tax on gifts Know when your gift is taxfree BusinessToday, In general, the gift tax and estate tax provisions apply a unified rate schedule to a person’s cumulative taxable gifts and taxable estate to. The annual gift tax exclusion in 2022 is $16,000.

Source: www.trustate.com

Source: www.trustate.com

IRS Increases Gift and Estate Tax Thresholds for 2023, What is a potentially exempt transfer? As per the law, as it stands today which was amended in 2017, gifts received by any person by any person or persons are taxed in the hands of the recipient.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, (these are the numbers you’ll refer to for federal. The annual gift tax exclusion in 2022 is $16,000.

Source: www.wealthmanagement.com

Source: www.wealthmanagement.com

How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, What is the gift tax limit? In 2023, the annual gift tax limit was $17,000.

Source: www.carboncollective.co

Source: www.carboncollective.co

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, Kapamilya daily mass | march 9, 2024. However, you’ll have to file a gift tax return if you gift more than $16,000 to another person in a single year.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Gift Tax Limit 2022 Calculation, Filing, and How to Avoid Gift Tax, The united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2024. Gifting more than this sum means you must file a federal.

Source: www.pinterest.com

Source: www.pinterest.com

What Is The Gift Tax And How Much Can You Gift TaxFree? Tax, Tax, Essential filing tips for 2024. Married couples can each gift $18,000 to the same person, totaling $36,000, up from $34,000 in 2023.

Source: cwccareers.in

Source: cwccareers.in

Gift Tax Limit 2024 Exemptions, Gift Tax Rates & Limits Explained, The 2024 gift tax limit is $18,000, up from $17,000 in 2023. Story by elizabeth constantineau, ai editor • 4d.

Source: credit.ly

Source: credit.ly

The Best Credit Repair What is the Gift tax? How the Annual Gift Tax, How much is the annual ‘gift allowance’? Gifting more than this sum means you must file a federal.

1.4 Changes To The Capital Gains Tax Rate On Uk Residential Property Disposals.

Gift tax exemption for 2024.

The Gift Tax Is Intended To Discourage Large Gifts That Could.

How much is the annual ‘gift allowance’?

The 2024 Gift Tax Limit Is $18,000.

Married couples can each gift $18,000 to the same person, totaling $36,000, up from $34,000 in 2023.